2024 Bonus Depreciation On Vehicles. Section 179 deduction for vehicles over 6000 pounds in 2024: The luxury car depreciation caps for a sport utility vehicle, truck, or van placed in service in 2024 are:

The percentage it was used for business is 60%. This is the amount you can deduct each year over the life of the vehicle.

While Section 179 Allows A Business To Deduct A Specific Dollar Amount Of New Business Assets (Like Vehicles Or Trucks), The Bonus Depreciation Allows Businesses.

For passenger automobiles for which sec.

Depreciation Caps For Suvs, Trucks And Vans.

List of vehicles to qualifying, depreciation, and irs tax credits

Please Explain “Used Property” As It Relates To Bonus Depreciation.

Images References :

Source: talyahwcarola.pages.dev

Source: talyahwcarola.pages.dev

Bonus Depreciation 2024 Vehicle Helli Krystal, The basis (purchase price + additional fees and taxes) of the vehicle is $40,000. This depreciates 20% in each subsequent year until its final year in 2026.

Source: www.fool.com

Source: www.fool.com

What Is Bonus Depreciation A Small Business Guide, This depreciates 20% in each subsequent year until its final year in 2026. For passenger vehicles, trucks, and vans that are used more than 50% for business, the bonus depreciation limit was $18,100 for the first year for 2022.

Source: www.gobankingrates.com

Source: www.gobankingrates.com

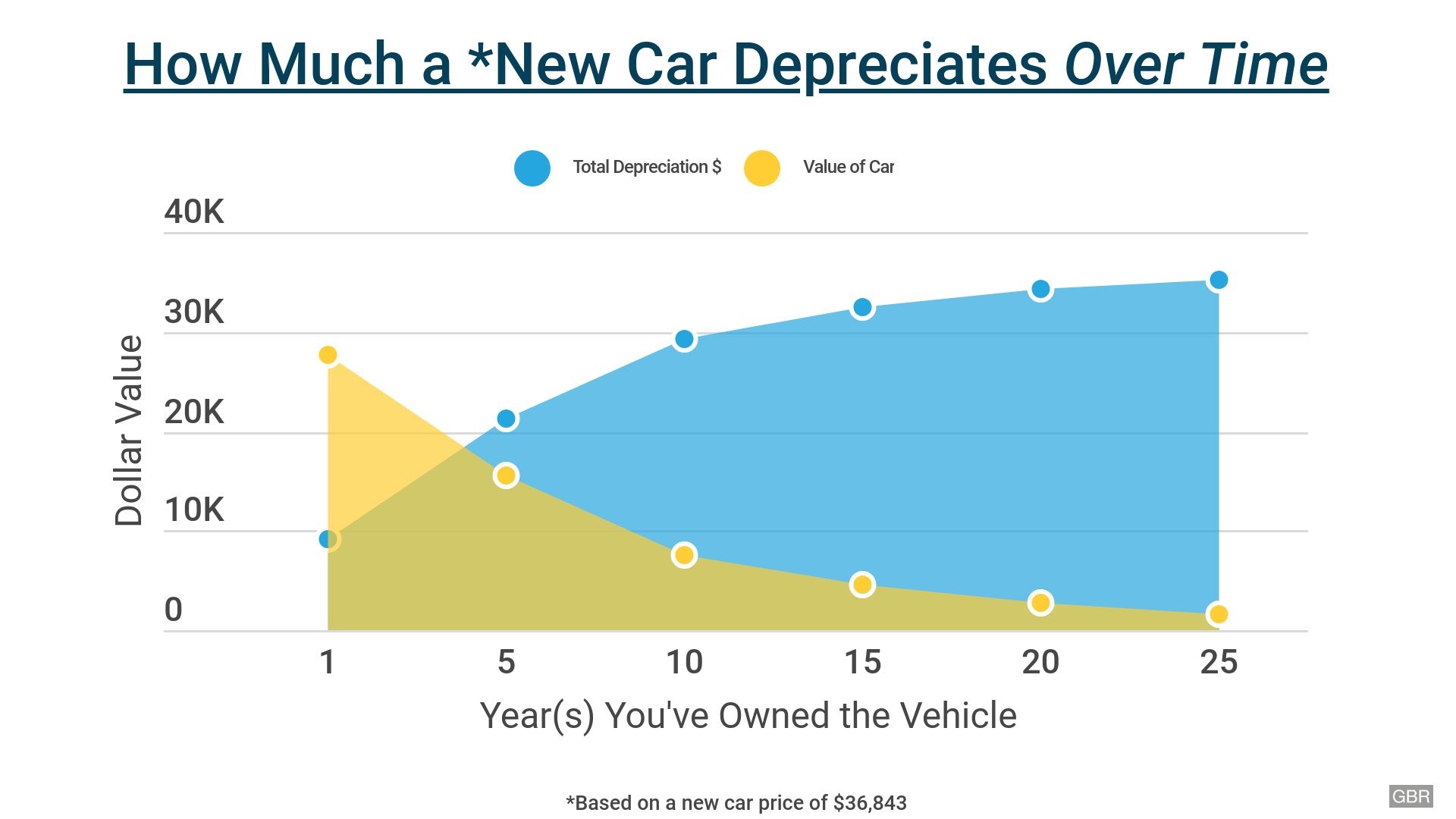

How Much a New Car Depreciates Over Time GOBankingRates, Section 179 deduction for vehicles over 6000 pounds in 2024: $20,200 for year 1 if bonus depreciation is claimed.

Source: www.wealthycorner.com

Source: www.wealthycorner.com

Watch out for Vehicle Depreciation Wealthy Corner, Phase down of special depreciation allowance. For 2023, businesses can take advantage of 80% bonus depreciation.

Source: loutitiawjoyan.pages.dev

Source: loutitiawjoyan.pages.dev

Section 179 Vehicles List 2024 Lynde Ronnica, The irs sets limits to keep things fair, and these limits have. Please explain “used property” as it relates to bonus depreciation.

Source: gpstrackit.com

Source: gpstrackit.com

The Ultimate Fleet Tax Guide Section 179 GPS Trackit, This depreciates 20% in each subsequent year until its final year in 2026. Depreciation caps for suvs, trucks and vans.

Source: www.bmtqs.com.au

Source: www.bmtqs.com.au

What Is A Depreciation Rate BMT Insider, For more information, check out the. This strategy includes trucks, suvs, rvs, and even motorcycles.

Source: haipernews.com

Source: haipernews.com

How To Calculate Depreciation Deduction Haiper, List of vehicles to qualifying, depreciation, and irs tax credits Among their differences, bonus depreciation allows you to deduct a percentage of the cost of eligible assets and property you have purchased.

Automobile Depreciation Table, For more information, check out the. Among their differences, bonus depreciation allows you to deduct a percentage of the cost of eligible assets and property you have purchased.

:max_bytes(150000):strip_icc()/car-parts-handled-by-robots-in-car-factory-152885764-061fe2cadd9a446caec7d943eb4c3715.jpg) Source: investguiding.com

Source: investguiding.com

What Is Bonus Depreciation? Definition and How It Works (2024), Lease inclusion tables for rented vehicles; This strategy includes trucks, suvs, rvs, and even motorcycles.

Vehicles Eligible For Bonus Depreciation Include Those With A Useful Life Of 20 Years Or Less, Such As Cars, Trucks,.

Bonus depreciation deduction for 2023 and 2024.

$12,400 For The First Year.

In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027.